Cash Flow Episode 4: Managing Cash Flow – Money In Vs Money Out

Hey there. It’s Jon here and this is Cashflow Episode 4.

If you recall, I decided that July is a cash flow month and I’ve made 4 videos. This the 4th in a series of 4 and I’ve talked about ways you can improve cash flow.

I’ve talked about how to loosen tight cash flow. Tight cash flow is not fun. You can’t pay people. It’s very stressful. There’s not enough money to do the things you need to do. It can severely restrict your business and your ability to grow. It can really stress you out and make you feel uncomfortable.

Steps to improve cash flow

1. Deal flow and margins. Stuff money into the business at the front. Do more marketing, do sales better, bring more jobs in and have better margins on each job. Charge more and pay less so there’s more profit in each one, which leaves you more money around and eases cash flow.

2. Knowing your numbers. I want you to test all your assumptions. You do you quotes based on a certain series of assumptions or estimates that you make and I think it’s important to test those assumptions on your way in to understand what your labor really costs you, what your trades really cost you, to check what your materials actually cost you rather than just relying on attainment metric rates or something like that. And then again on the way out, when you finish the job, to reconcile and test whether your numbers were actually right, whether you didn’t make that money you know, when you look at timesheets and things like that.

3. Dragging the money in. This is really important. So many of us are too chicken to call somebody up and say, “Where’s my money?” And I talked about the power and the value in doing that – in being consistent and persistent, in having a good system, in having agreed terms and in following up in terms, and enforcing your terms. And if people don’t pay, then escalating quickly and not letting things dragged out for months.

4. Managing cash flow. Today, I want to talk about managing cash flow. What I mean is – what a lot of people do is ignore it and look away from the difficult sh*t task of managing cash flow or the difficult and uncomfortable problems you’re going to have to confront when you don’t have enough money to pay somebody until they smack you in the face and you have to deal with them. Most of us will go and work on what we like. We’ll go and try and get more money in, more jobs, and do more quotes. We’ll try and do more work. We’ll try to make that happen so some money comes in and we don’t do the difficult things.

But, you can and should be disciplined about managing your cash flow. And in fact, most people will manage it in a kind of informal way in your head, you know there’s a bill coming, you’ll think about how to pay.

A better way to manage cash flow

Manage your cash flow by building a cash flow forecast, and then look at it frequently (at least once a week) and use it to help you make decisions.

The point of this is that you can make decisions and take action sooner and you can head problems or even avoid them all together by getting in there early enough.

Recommended Reading: Cash Flow Episode 2: It’s Important To Know Your Numbers

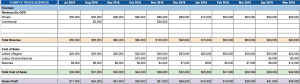

What to do? This is what a cash flow forecast looks like.

What you do with the cash flow forecast is to track the money coming in – Revenue (Money In).

- For – January, July, August, September, October, November (the Australian financial year).

- You can do whatever months or weeks you want. If you’re a trade business, you might find that weeks is a better way to manage it. You forecast what money is going to come in.

- If you have a business that’s reasonably consistent, you might go $50,000 a week, or $5,000 a week and do it like that.

- Maybe you have a different or lumpy revenue stream, you might say I’m expecting a $100,000 in August and only $20,000 in September and then no progress payments until November. You might have that kind of thing going on.

Forecast when:

- Your payments and your money is going to come in and do the same for your costs: your costs of sales, your labor and materials for your trades, and your jobs.

- You’re going to need those and your subcontractors if you use subcontractors.

Do the same with: your overheads, with your rent, and your admin wages, and your own wages, your insurances, and your business coach. (I put myself in there, for I might be good). You should have a business coach. Forecast him as well and his cost to you.

Forecast these things. Anyone have some that are the same every month or every week and you’ll have some that come once a year (car insurance, business insurance). You can put them in and forecast when you’re going to have to make these payments.

And your last line is a net cash flow, which is the money in minus the money that’s going out. Not very difficult.

- If it’s a positive number and the money in is more than the money out, you don’t really have a problem.

- If it’s a negative number, you do have a problem. There’s not enough money coming in that month to pay for all the stuff that’s going to have to go out so you’ve got to find money from somewhere else. If you’ve got some notice, if you can see that 3 or 4 months away, and you could not spend and you can save some money up.

You’ve got time to take action just because you’ve got lots of expenses at some months. You can save up, you can borrow money, you can put in your credit card and expect to sort yourself out.

If it’s some more problematic than that and cash flow is consistently poor, doing this might jolt you into making some tough decisions like cutting some costs, or even letting go of some people or something like that. If it’s that bad, you might need to make those tough decisions. At least if you do this, you know instead of hiding from it and then it will creep up on you and smash you in the back of the head when you have to fire people, or you can’t pay bills, or you can’t pay wages, or somebody tries to shut you down because you’re not paying them, or you’re involved in that horrible stressful juggle of trying to pay people a bit at a time.

So, I implore you as a business coach and somebody who likes to encourage people to build systems and structure in so that you have this control in your business and you reduce this stress – do your cash flow.

I’ve gone to a little bit of trouble of building a template for you. If you want to, send you us your details below where we can send it. It’s free, I’m not charging.

If you want help to fill it in, which brings up an important point (this is boring, sh*t to do), if this isn’t your skill and you’re not very good at this, get someone else to do it. Get your bookkeeper to do it, or your admin person to do it, somebody who’s better. I’m not good at this stuff. I find this dreadful. They’re really difficult but someone in my team does it and Lindsey rather enjoys it, I think, and it helps her feel in control.

So, do that, don’t be afraid to delegate. Download the ‘Cash Flow’ template above.

And if you want help to fill it in or if you want help to make some decisions about what to do with the completed cash flow forecast you’ve made, of course, book a 10-minute chat with me and we’ll have a quick talk.

See you later.

There are four ways you can engage with me:

1. Subscribe to these emails and get them once a week in your inbox so you never miss a video from me.

2. Join the Trades Business Toolshed Facebook Group where you can watch these videos, ask me questions or talk to your peers.

3. Attend my next Tradie Profit Webinar.

4. Book yourself a 10-minute chat with me. We’ll talk about whether coaching is right for you now and if it is, we’ll go further into the process before you have to make your mind up.

See you later.