WHERE TO BORROW MONEY FOR YOUR TRADES BUSINESS?

What’s the best place for a business to borrow money?

This is a question I saw on Facebook in Carpenters Talk Group which is part of the Builders Talk Group family. I’m involved with the Builders Talk Group and you’ll find these videos or some of them on the Builders talk Group website if you want to look at them.

So this guy asked this question – He wants to borrow £30,000.

He got some interesting answers ranging from ‘Hang some doors for a week and you’ll be fine’ to ‘Ask your dad, and phone Dave, and here’s Dave’s number, and some legitimate referrals to finance companies who can lend you money’.

And apart from the piss-takers, these are all valid options.

So I thought I might explore them because requiring money to help fund some business growth is a common thing for us to do.

Not everyone has to do it. Some lucky business owners make enough money from the start so that they’ve got enough money to fund the growth that they want to fund, but some people don’t.

And there are number of reasons you might want money. And there are a number of options to choose from.

The reasons you want money, your financial position, your circumstances and how much money you’re prepared to pay for, are all factors in determining what your options are.

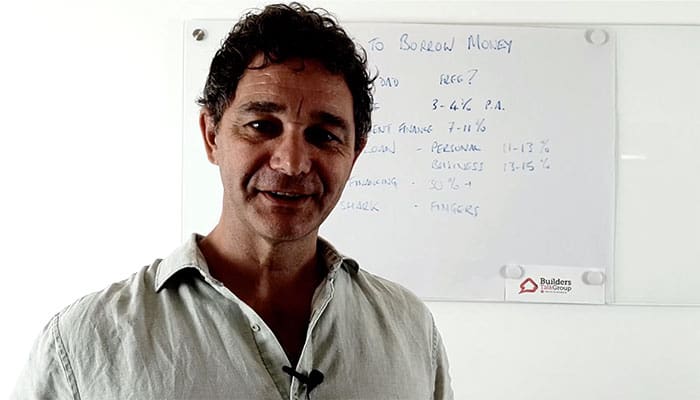

6 options on where to borrow money

Here are some options from a business coach’s perspective. It is my disclaimer. I’m not a financial adviser. In Australia, only people with the Financial Services license or Financial Advising license like accountants and financial advisers, are allowed to give personalised financial advice, so this isn’t that. This is my opinion and you must seek personal financial advice based on your own position.

Let me give you some examples.

1. Borrow from Mum and Dad

The cheapest way to get money for your business is to borrow it from the bank of Mum and Dad. Borrow some money from somebody you know who can lend you some money as a favor to help you. They generally charge nothing.

They’d be more rudimentary in looking at your finances. They’d be doing it to help you. So if you can get access to money from Mom, or Dad, or friend, that’s the first place you should go looking. And in many instances, when we look at successful, wealthy people who have made their millions, they all had help from family members or friends, so don’t think that you shouldn’t do that or that it’s cheating.

Successful people have done it and and you should too if you can. If you’re lucky enough to have your own personal private stash of money, you should look there first because borrowing money from an institution like a bank is going to cost you.

2. Your mortgage

The next cheapest is to pull it out of your own mortgage. If you have equity in your property, you have sold your home or have an investment property that you can access to then that’s the cheapest way for you to borrow money. It’s going to cost you 4% or 5% in Australia and 2% or 3% in the UK.

So, that’s a cheaper option. It feels a bit more risky because you’re securing it against your house but it’s less risky for the bank which is much cheaper. You’re talking mortgage interest.

3. Asset equipment finance

The next option is a secured loan but not against the property.

Often, when you go and look for a business loan from a bank, they’ll want you to sign a guarantee and try and secure it against your property, anyway. So be careful if you look at business loans, when they ask you to sign a guarantee because if you default, they’ll come after you and try and make you sell your property or security. So if you have a secured loan, it’s going to be secured against something.

Secured loans but not against property, I’m going to call that ‘Asset And Equipment Finance’. And that usually really applies when you buy a vehicle, digger or some equipment and the lenders can secure the loan against your plant and equipment, which means it’s lower risk for them and you can get interest rates of 9%, 10% or 11%, which is great.

Recommended Reading: Look After Yourself (Episode 2) – The Best Ute (Vehicle) For You

4. Unsecured loans

The next option is unsecured loans.

If you’re not buying a vehicle for them to secure something against, like property, then your next option is an unsecured loan.

You can get a personal one or a business one. And they’ll want to see your financials, personal or business for comfort that you can pay back the loan.

You may or may not be entitled to get one, and they’ll cost you more. They’ll cost you between 11% – 15% because they’re higher risk. And business is higher risk than a personal one because you can fold a business and they’ve lost everything.

You see we’re getting more and more expensive now.

5. Credit cards

Credit card’s interest rates vary between 15% and 22% so they’re good for a few $10,000 dollars and good for a short-term fix if you know some money is going to come in. But beware the danger of borrowing on credit cards, not paying them back and paying thousands of dollars every month in interest. It’s an easy and common trap to fall into. So beware with credit cards.

At least with a business loan, you’re going to pay a monthly fee and it’s going to be paid back after 2, 3, 4 or 5 years.

6. Invoice financing

People will secure some finance against your invoices.

You raise your invoice, say $50,000 on one of your customers, they’ll give you most of that 80% or 85% right away so you get the cash flow into your business. And when your customer pays the invoice, they’ll give you the rest and they’ll charge you a fee. They’ll typically charge you 3% of invoice as a handling fee.

3% of an invoice if you’re invoicing every month, is a lot of money. 3% of your annual turnover is a lot of money to spend so it’s expensive financing.

You could get access to 85% of what you invoice every month if you need lots of money.

It’s a valid option. But it’s like crack, it’s very hard to wean yourself off it.

So again, be weary.

7. Loan shark

I think from my perspective, obviously, there’s the Loan Shark and you can often pay with some fingers.

Borrowing money is expensive. Consider the cheap options first if they’re available to you, and only gravitate to the more expensive ones if you really need to and if you think you’re going to be able to pay it back.

If you borrow $100,000 at 20% per annum, that’s $20,000. 15% per annum, that’s $15,000 every year until you’ve paid it back. It’s a five-year loan. You’re talking $60,000 of interest.

Beware. It’s expensive and repayments can hamper you in other ways. It’s not always the easy and quick fix that it can feel like.

And I hope that’s helped you with your choices.

Don’t underestimate the opportunity of borrowing money off parents, or your own property, and things like that.

Of course, you could always sell a child or a kidney, if you want some cash, if you think it’s a worthwhile investment on to your business.

And of course, you should talk to your advisers, your business coach, or talk to me, particularly, or talk to your accountant and get them to think through what your options are.

A big mistake to make is to borrow loads of money thinking it’s going to fix everything and find that actually it’s digging you a deeper hole, so be weary. Consult your advisers, be cautious.

And of course, if you do want to talk to me about business coaching or about whether to borrow money

There are four ways you can engage with me:

1. Subscribe to these emails and get them once a week in your inbox so you never miss a video from me.

2. Join the Trades Business Toolshed Facebook Group where you can watch these videos, ask me questions or talk to your peers.

3. Attend my next Tradie Profit Webinar.

4. Book yourself a 10-minute chat with me. We’ll talk about whether coaching is right for you now and if it is, we’ll go further into the process before you have to make your mind up.

See you later.