True Cost of Employment (For Trades Business)

It’s really easy to not properly understand what your employees really cost you or your contractors. And that becomes a problem when you don’t charge enough for them.

So what I’m going to try and do today is help you understand and get some clarity on how much they actually cost and how much they actually cost you, not just in terms of the hours that you pay them but the hours that you can get paid for them and relate that to how much you charge in an hourly rate that you charge out. I think that’s a meaningful equivalency for us to think about here.

(This is a long video, I think it’s about 8 minutes so here’s the short version if you can’t be bothered with all that).

Shit loads more. They cost you shit loads more than you think, almost double what you think you’re paying them – in the instance of an employee and about half as much again in a contractor. So lots, bucket loads more than what you thought.

So let’s get stuck into the calculation.

I’m going to work out the cost of an employee per hour that you charge. So we’ll start with an employee… a permanent employee.

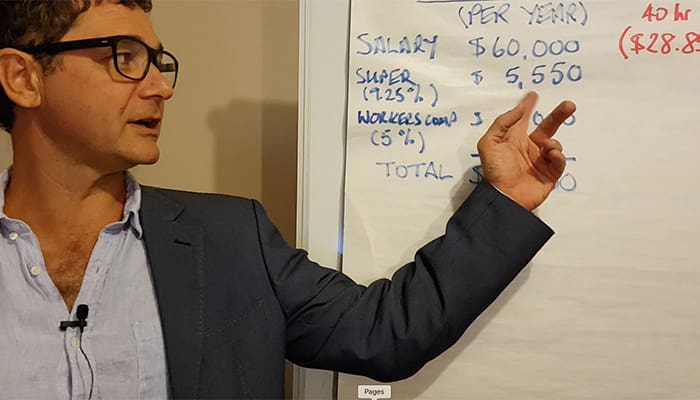

Take a $60,000 year’s salary and divide that by 40 hours a week. You’ve got $28.85 an hour, that’s what we normally think when we do these sums, isn’t it?

But you’ve got to add Super 9%, 9 and a quarter (9.25%), and that’s $5,550, you’ve got to pay. Worker’s Comp is about 5% so that’s $3,000, so before you’ve started got $68,550, which is about 12% more than what you thought.

Well I’m finished. (This is so much fun).

RELATED CONTENT: Employees or Independent Contractors?

A full year is 52 weeks. You pay 4 weeks holiday so you’ve got 48 weeks. We pay 5-day weeks, don’t we? So 48 weeks is 240 days but you have to pay 10 sick days so down to 230 working days and yet we have to pay 13 public holidays so we’re down to 217 paid days but 8 hours a day that’s 1,736 hours that you’re paying people for.

So if you divide your $68,550 by 1,736 hours, you’ve got $39.48 per hour that you pay them, that they work. I still haven’t finished.

Add a car.

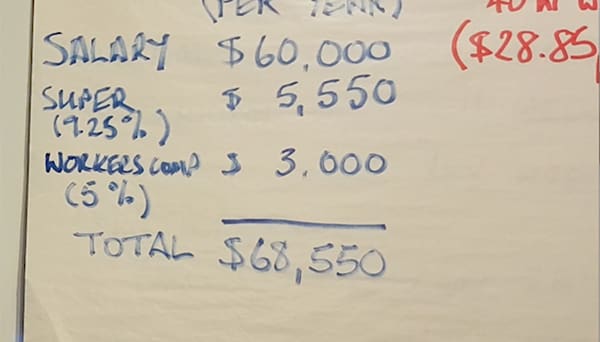

Most trades people need to be given a vehicle in order to properly do their work. Cars cost about $12,000 a year. Think about the lease, the insurance, the Rego, the tyres, the petrol, the maintenance, and you’re talking $12,000 so divide that by 1,736 hours and you’ve got to add another $6.91 per hour, so that brings out hourly rate that you pay them up to $46.39.

But wait, I still haven’t finished. Do you actually get to charge them out for 40 hours a week? I don’t think so. Do you have systems in place to measure it for a start or are you just saying, “yeah I think I do Jon”? Because I’m going to tell you I’ve never met anybody who is doing this properly.

- Let’s talk about travel time to and from jobs.

- Let’s talk about smoko and lunch breaks.

- Let’s talk about driving to get materials from Bunnings or whatever.

- What about cleaning the shed when there’s no work to do or fixing up the van and loading up the van with stuff in the morning before they go out?

- What about when you quoted a job to take 22 hours but it took them 24?

- What about the apprentice and his days at TAFE?

- What about RDOs?

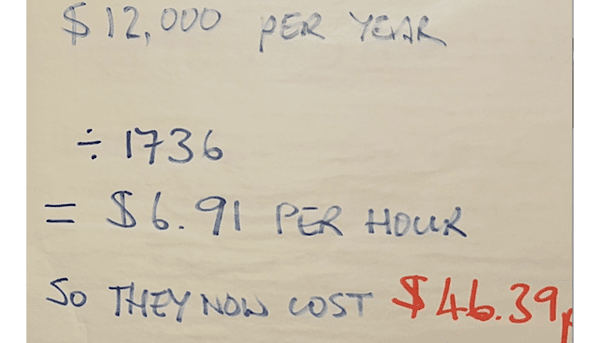

Even the best businesses are lucky to get 80% of the time that they’re paying their staff back as hours charged.

I worked with an accountant and she had three accountants working for her and her target for them was 80% (which they would achieve), but they don’t have to drive anywhere, they don’t have to go and buy pipes or nails or anything. They’re sitting at their desk all day long and she feeds them with work all day long. She was very good at that and they got 80%.

So let’s be generous and say your guys do 80% on average.

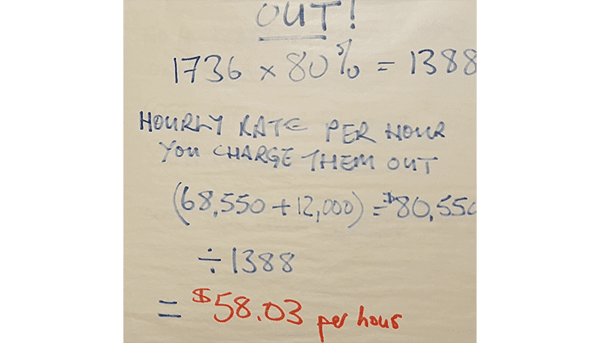

So now we’re looking at the cost per hour charged out. So 80% of 1,736 is 1,388. So the hourly rate that they’re costing you per hour you charge them out, is your $68,550 plus your car.

$80,550 divided by that 1,388 is $58.03 per hour. This is what they’re costing you.

$58.03 per hour that you get to charge them out to your clients. This isn’t great, is it?

If you’re charging $50.00 an hour, you’re in a whole heap of pain, aren’t you? You’re charging $65, you’re not doing real well because remember that the gross margin, the $65 minus $58, that $7 an hour, needs to pay for the rent, all the overheads of your business, the rent for the office or the shed, the admin staff, your salary, and your vehicle, your insurances, your marketing, your accountant, your expensive business coach (!) which you should have by the way, your tools, your IT, and your software, that’s before you make any profit. So $7 margin an hour, you can have to have a lot of guys working a lot of hours charging out a lot of hours, before you start to get your money.

I’m going to stop because how much to charge and how to charge more are different topics and I’ll cover them another day.

I’ll just quickly run by the same calculation for a contractor.

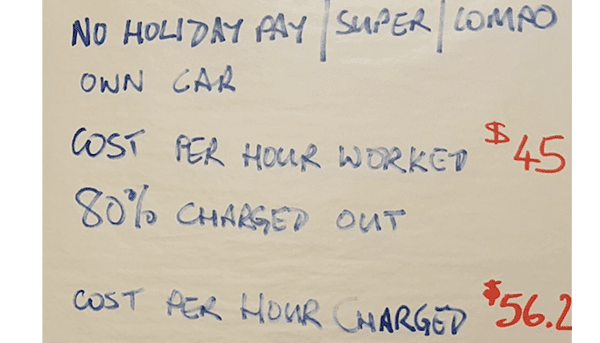

So here’s a contractor because I know what you’re thinking, “Oh I’ll put them on contract, I won’t worry about all that shit.” But what happens is you don’t have any holiday pay to worry about or super or workers comp and they bring their own vehicle but they charge more per hour and it kind of balances out.

So I pick $45 an hour, I don’t think that’s unreasonable to be paying a subbie or contractor. 80% charge down again, that same rule still applies, you pay them by the day or the week not for every hour they clock on and off, so the cost per hour charge becomes $56.25 again, almost the same.

And you might fall foul of the sham contractor rules. I know we think there are ways around it if they quote proprietary limited and if they quote for jobs but actually the government’s trying to close those loopholes and you might get caught and you might be pissed off when you do.

I had a client who got pinged by the ATO and he got a $50,000 bill and they audited him for the next 3 years as well so he couldn’t get away with anything else. So it was a significant risk he took and that’s before you consider the fact that what you’re saying when you’ve got an employee who you really only pay as a contractor is fuck you a bit, we don’t really care about you, you’re not really one of us, you’re not really on our team, and if there’s no work on Monday, you won’t be getting paid.

So you know, understand the impact that has on the culture, and on that person’s loyalty, and on how your team works as a group.

Nearly finished.

If I’m coaching someone we try to make sure we understand this, we understand how that works in their business, how much they’re paying their employees compared to how much they’re charging out. We try to understand if they’re recovering that money properly, if they’re charging enough, if they’re quoting accurately. We need to do it by job, and we need to do it by a working unit which might be a guy or it might be a vehicle and 2 people.

So here’s my question for you and of course I’m going to ask you to comment below in the comments…

Do you know how profitable your jobs are? Every job?

Do you know how profitable your guys are or your girls and everyone or every working unit that vehicle and 2 people?

And if you’re all smart and clever, and you’ve got systems in place to measure this and you know you’re doing a great job, comment that and tell me and I’ll be impressed!

And if you don’t really know and you kind of hope, then comment that and fess up because I think that would be interesting to see how many of you are on which side of the fence.

Anyway, happy days. See you!

There are four ways you can engage with me:

1. Subscribe to these emails and get them once a week in your inbox so you never miss a video from me.

2. Join the Trades Business Toolshed Facebook Group where you can watch these videos, ask me questions or talk to your peers.

3. Attend my next Tradie Profit Webinar.

4. Book yourself a 10-minute chat with me. We’ll talk about whether coaching is right for you now and if it is, we’ll go further into the process before you have to make your mind up.

See you later.